Employee Retention Credit Eligibility Guidelines

The ERC is a refundable credit that businesses can claim on qualified wages paid to employees.

A business may be eligible based on the following guidelines, even if they accepted the PPP loan:

- Timing: Deadlines are based on the due date of the originally filed 941. For quarters ended before July 1, 2021, it is the original date plus three years. For Q3 2021, it is 5 years after the due date.

- Experienced a significant decline in gross receipts during a calendar quarter compared to 2019 -OR-

- Had operations fully or partially suspended due to government orders limiting commerce, travel, or group meetings due to COVID-19.

- A significant decline in gross receipts for 2020 is defined as a decline of greater than 50% in a calendar quarter in 2020 compared to the same calendar quarter in 2019.

- For 2021, the definition of a significant decline in gross receipts was modified to be a greater than 20% decline in a calendar quarter in 2021 compared to the same quarter in 2019- we will work with you to find the correct calculation.

- It is often necessary to aggregate the revenues and employee counts for affiliated and related businesses for qualification purposes.

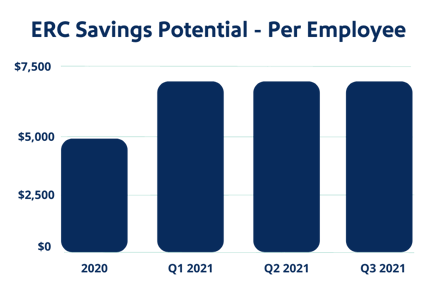

The annual cap on credit amounts has increased from $5,000 per employee in 2020 to $7,000 per employee for each quarter in 2021 for a potential of $26,000 per employee combined.

Note: This credit is still available even if the employer received the initial $5,000 maximum credit in 2020.

Fill out the form to connect with a TaxCredible professional to discuss your company or client's eligibility and savings for tax incentives.